1974

DR. PROFESSOR JOSE FRUTOS DISCOVERS ESCONDIDA COPPER MINE

Vicunau co-founder Dr. Professor Jose Frutos conducts first-ever exploration of the claims “Colorado 1 – 2,000” and “Zaldivar 1 – 2,000” now known as the world’s largest copper mine Escondida.

1975

VICUNAU DIRECTOR ENRIQUE VITERI CHIEF GEOLOGIST AT ``EL TENIENTIE``

Vicunau director Enrique Viteri-Aldunate appointed as Chief Geologist at the famous Chilean state owned “El Teniente” copper mine, discovered in 1819 and considered the largest underground copper mine in the world, employing 5,000 people.

1980-90

ENRIQUE FIRST BEGINS EXPLORING IN MARICUNGA & VICUNA

Appointed Senior Exploration Manager at Anglo American Corporation Chile, credited with first exploring some of the largest mega copper & gold projects in the Maricuna, including Caspiche /Norte Abierto (Barrick & Newmont), Refugio/Maricunga (Kinross), Esperanza (Antofagasta), Lobo Marte (Kinross), El Indio (Barrick), and Manto Verde (Capstone).

In 1988 Anglo becomes first to drill Caspiche, led by Vicunau’s Enrique Viteri. According to the Caspiche NI43-101 Report: “Anglo were first to drill the project using an open-hole Holman rotary air rig with a depth capability of 50 metres. A total of 12 holes for an aggregate of 580 metres were drilled. Cuttings were collected on two metre intervals and assayed for Au, Ag and Cu. A minute fraction of the drilling cuttings were glued to heavy paper sheets to represent each drill sample. In 1990 Anglo drilled six RC percussion holes for a total of 950 metres using a company owned Falcon 40 drill rig. Beyond the fact that samples were collected over two-metre intervals the Anglo reports do not describe the specific sampling protocol they followed for either of these drill

campaigns.”

1993-94

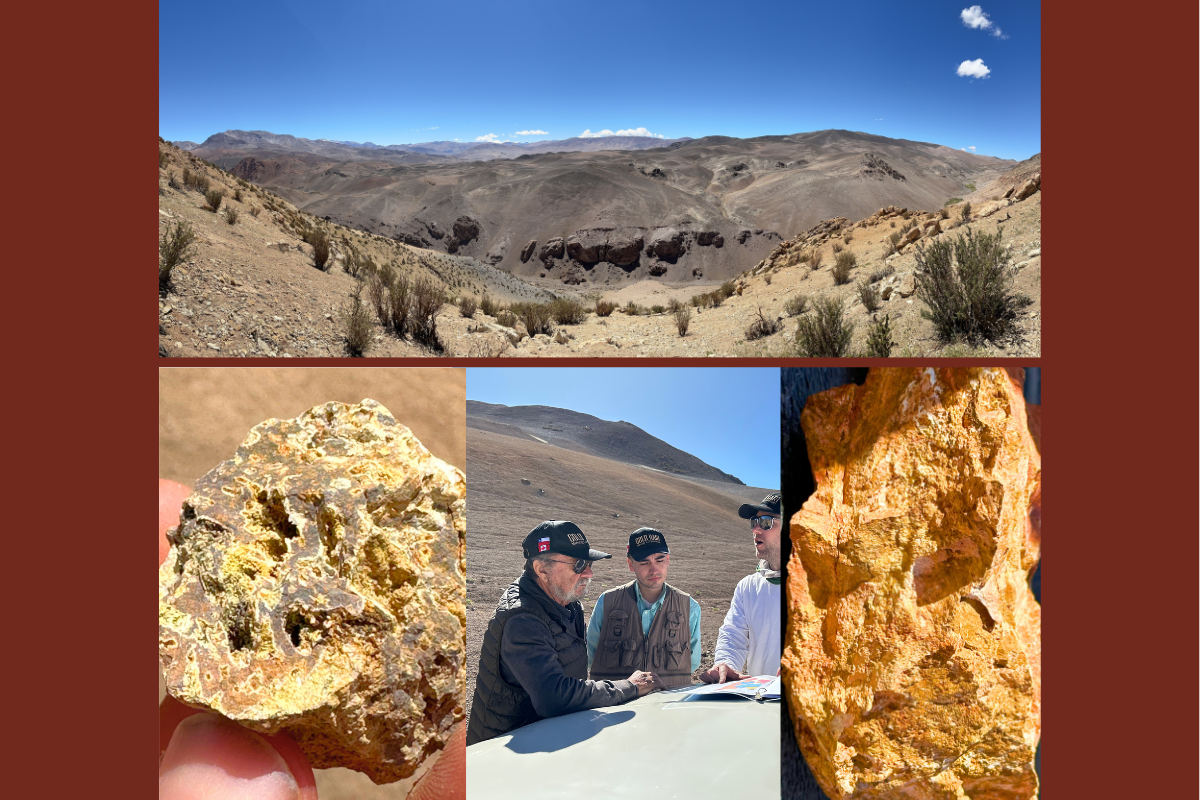

ENRIQUE VITERI DISCOVERS VICUNAU'S TORO & TOLITA PROPERTIES

Enrique quickly identified Toro and Tolita as his prized assets, staked for his own personal family holding company after having been involved in the region’s largest discoveries. Vicunau assets Toro and Tolita had uniquely high grades of copper, gold, and silver on surface. For example, Enrique rarely saw 1g/t+ grade gold on surface at even some of the largest assets in Maricunga, but Toro & Tolita have such high grade gold in trenches all across the properties.

Tolita has a super high grade trench with 4% copper and 50g/t gold, extremely unique for any porphyry district but particularly for the region of Maricunga / Vicuna, Chile.

1995-98

VICUNAU ASSETS TORO & TOLITA PROJECTS FIRST DRILLED

Quickly after staking the Toro and Tolita projects, different companies acquired options to explore the assets. During this time, gold was trading at $300-400/oz and copper at $0.75-1.00/lb. Tolita displayed anomalous zones of silicification and fine stockworks, and a road was quickly built to conduct 2.5km of trenching, yielding uniquely high grades for the region.

Between 1995 to 1998, 3,827 geochemical samples were analyzed at Toro & Tolita. Helicopter magnetic surveys were run (7), and 8.6km of trenching has been conducted, resulting in high grades of copper, gold, and silver.

The third company to option Toro & Tolita was Indogold, which drilled 9 holes totalling 1,800m (9x200m RC) with surprisingly long intercepts of gold & copper on Tolita, and gold & silver at Toro. Indogold ran into issues around 1998 due to another Indonesian gold stock collapse, and Enrique Viteri was able to recover the assets.

2001-09

DR. FRUTOS DISCOVERS CERRO CASALE & APPOINTED TO NATIONAL GEOLOGICAL SURVEY

In 2001, Dr. Professor Jose Frutos was appointed as Deputy Manager of the National Geological Survey of Chile (Sernageomin), responsible for the country’s geological reports. He also served as Chile’s Geological Survey, National Head of the Regional Geology Division.

In 2005, Dr. Frutos was apart of the lead discovery team at Bema on Aldebran, now known as Cerro Casale of the massive Norte Abierto Complex controlled by the world’s two largest mining companies, Barrick and Newmont-GoldCorp. Bema & Casale were acquired by Kinross for $3.5-Billion.

2012-20

VICUNAU CO-FOUNDERS BEGIN ANALYZING ASSETS FOR POTENTIAL ACQUISITION

Vicunau co-founders Isaac Maresky & Jonathan Warner worked together as mining analysts at a boutique investment bank, analyzing hundreds of assets held by both private and public companies. Jon left the banking world to pursue work with major mining companies Agnico Eagle, Vale, and Newmont-GoldCorp, but the pair kept in close touch trying to uncover unique properties with gold, copper, and silver potential. In 2018, Jon & Isaac decided to hone in on Chile as both a stable country home to major miners & the world’s largest producer of copper, given the region was quieter than usual due to a soft market. Jon and Isaac met Dr. Professor Jose Frutos, who discovered Cerro Casale before staking Cachitos for himself, and theorized about the potentiality of acquiring other adjacent properties. At the time, the Vicuna Belt was not named, still referred to as the “Link Belt” due to the question mark hanging over the potential of the region.

2021

VICUNAU FORMALLY INCORPORATED (GOLD HART COPPER) WITH CACHITOS AS FIRST ASSET

In 2021, Jon, Isaac, and Dr. Frutos incorporated Vicunau with Cachitos as a starter asset. Cachitos sits directly adjacent to the country’s largest gold-copper asset (Norte Abierto / Cerro Casale) controlled by the world’s two largest mining companies (Barrick & Newmont-GoldCorp). It still remained a big question as to whether additional assets could be prudently rolled up, and whether or not the region South of Casale (the “Link Belt”) would turn out to be prime real estate. Of course, Vicunau has gone on to acquire several additional prime properties and the Link Belt – now Vicunau Belt – has become the world’s top copper region with Lundin, NGEX, Josemaria, and Filo multi-billion dollar discoveries.

After acquiring a few other early stage properties, Vicunau partnered with Enrique Viteri-Aldunate in acquiring Toro & Tolita, the most advanced properties in the portfolio.

2022

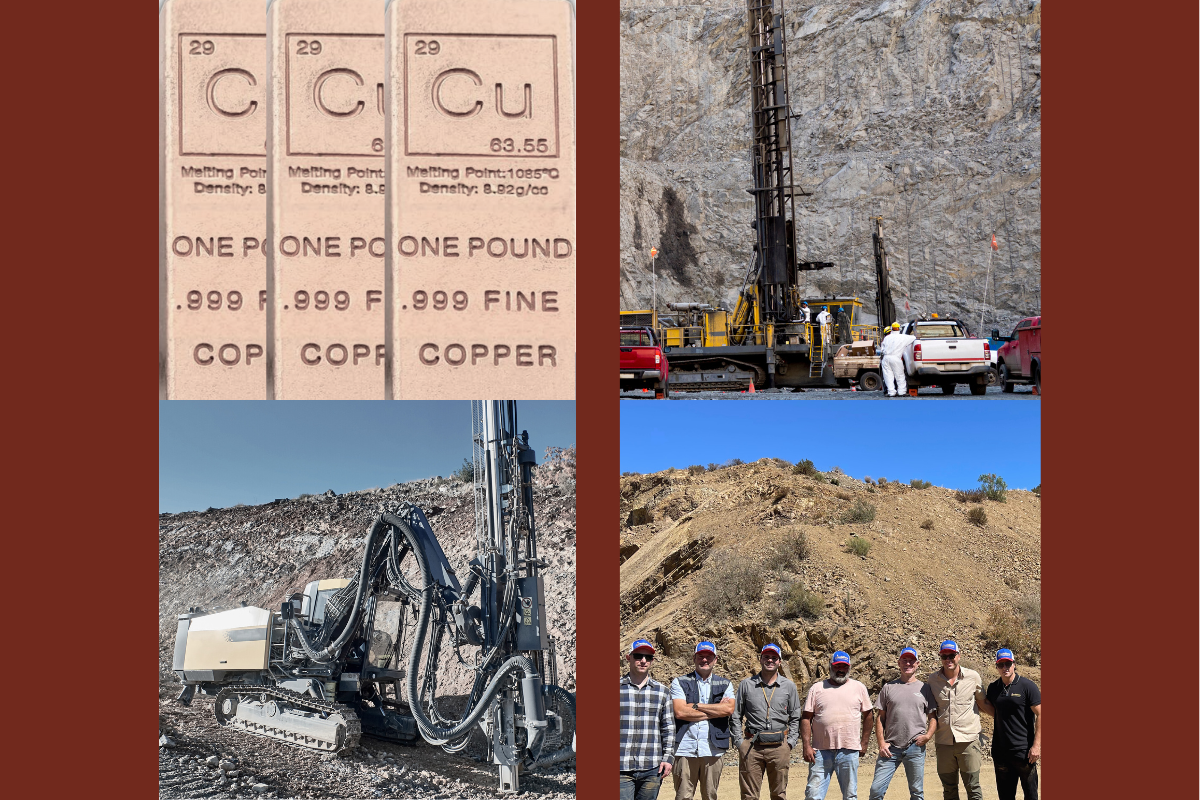

VICUNAU ACQUIRES TORO & TOLITA DRILLED ASSETS

After increasing Vicunau’s land position by 10X and proving the upside of the roll-up strategy, Vicunau was able to partner with Enrique Viteri-Aldunate, a top Chilean geologist, in order to acquire Toro & Tolita. Toro & Tolita are 2 drilled properties with significant history, recognized in the earliest days of the Maricunga & Vicuna Belts as having the same characteristics as the other major copper & gold assets. Importantly, Vicuanu was able to acquire these assets utilizing the same partnership-based approach, resulting in Enrique as a true aligned partner, and the asset held outright without any royalties.

IP Anomaly Consistent With “Cerro Casale, Caserones, Refugio”: Vicunau then quickly launched an IP Survey, something that was recommended for these properties for decades by all geologists who visited. Vicunau retained a top IP firm which has conducted over 1,000 geophysics surveys in Chile, including for major deposits like Atex’s Valeriano. The results of the IP Survey were 2 “spectacular anomalies” as described by the 3rd party geophysical scientists. The Tolita anomaly, in particular, is strong and massive in size (2.5km squared) and completely open to the North where Vicunau has already discovered copper oxides at surface.

FUTURE

ADVANCE ASSETS & CONTINE ROLL-UP

Advance Assets – Drilling Towards Copper-Gold Resource: With a prime property portfolio including multiple drilled assets and Tolita perhaps the only untested porphyry in the Vicuna region, Vicunau is extremely excited to drill this property with a vision of delivering a maiden copper-gold resource. The Company believes that these assets, with decades of history, since before the Vicuna Belt was even named, deserves a robust drill campaign. The Tolita IP anomaly is so large that the ideal scenario will be 15,000 – 20,000 meters drilled over 2 seasons.

Continue Acquisitions & Roll-Up Strategy: Vicunau has proven that the roll-up strategy is doable. Having already rolled up several assets while avoiding the archaic option-model, the Company is able to advance projects without liabilities or royalties. The Company has analyzed over 100 other claims in the region, some even more advanced, and believes the roll-up strategy will continue to have significant potential.