TOLITA - COPPER | GOLD | SILVER PORPHYRY

Vicunau believes Tolita to be the only untested, fully preserved copper-gold or gold-copper porphyry system in the Maricunga / Vicuna Copper & Gold belts.

With decades of history, Tolita was recognized very early on (1993) as a high-potential asset by Enrique Viteri-Aldunate, one of the pioneers of the region.

Enrique spent a decade with Anglo American which conducted much of the early exploration in the region. He drilled the first holes at Caspiche (Barrick/Newmont Norte Abierto), worked on the famous Kinross Refugio/Maricunga Gold Mine, and was the Chief Geologist for Chile’s state owned El Teiente Mine, considered the oldest & largest underground copper mine in the world.

Tolita has had decades of exploration & development; all signs pointing to a large copper-gold porphyry:

- Geochemical Samples: 3,827 geochemical samples tested including countless high grade at surface copper and gold anomalous values. Compared with other large deposits, the grades at surface are excellent.

- Magnetic Surveys: Four helicopter magnetic surveys conducted with uniquely anomalous results characteristic of large systems

- High Grade Trenching: Tolita has had 5,600m+ (5.6km) of trenching, with exceptional grades for the region, including a “super high grade trench” at surface with 4% Copper & 50g/t Gold

- Excellent Initial Drilling: Tolita has had 3 holes drilled for 674m, drilled blindly (no IP), and still hit long porphyry-style intercepts including 2 of 3 holes which intersected 150m of 0.37g/t gold equivalent and 165m of 0.31g/t gold equivalent, having only tested for gold and copper. It was very rare in other large deposits to have such long intercepts in phase-1 drill campaigns so close to surface.

- Massive IP Anomaly: Recent IP Survey confirmed “spectacular” anomaly consistent with large porphyry deposits, 2.5km square in size with high chargeability and close to surface

TOLITA - COPPER | GOLD | SILVER PORPHYRY SYSTEM

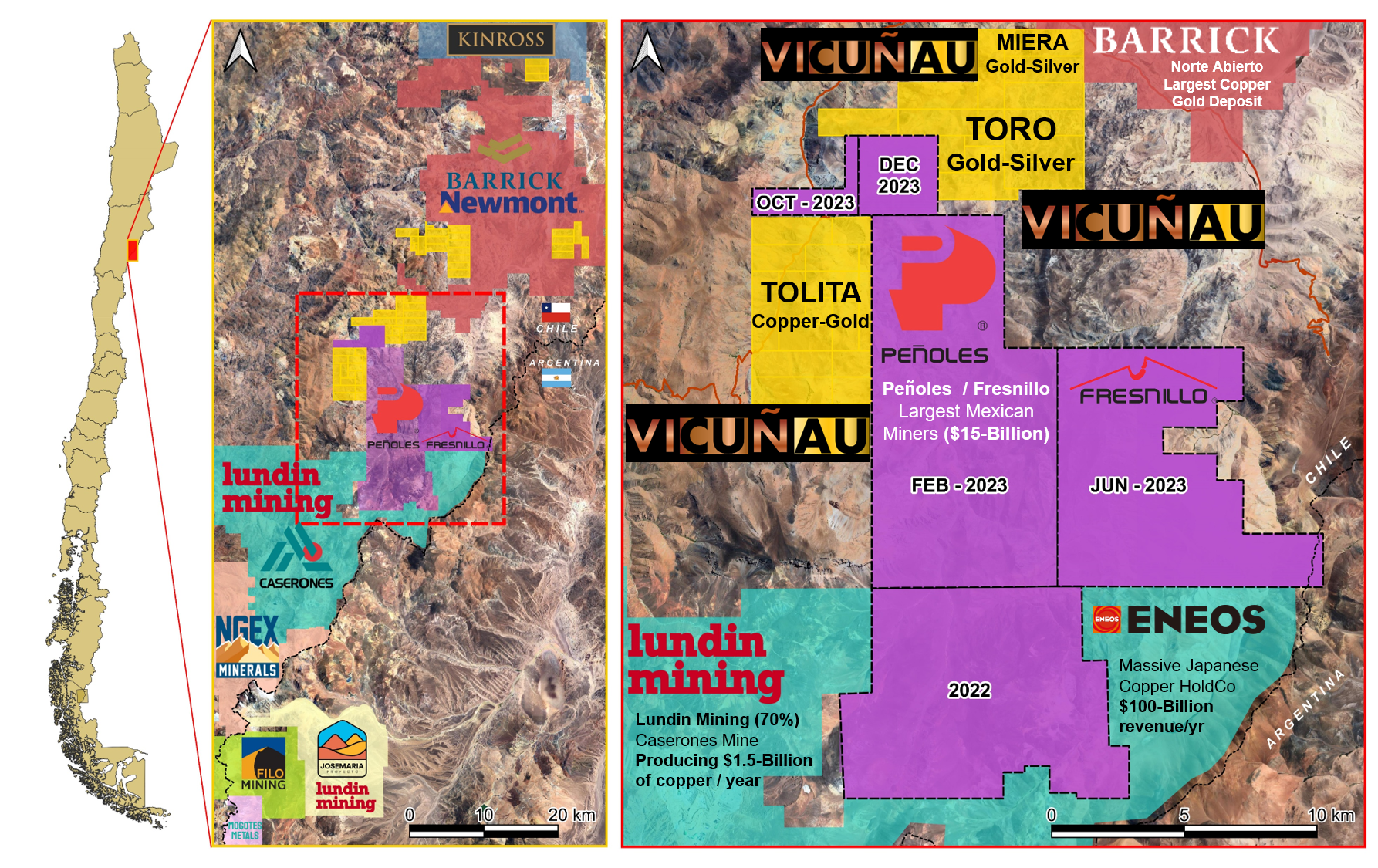

Tolita - Surrounded by Penoles / Fresnillo with Lundin's Caserones Immediately South

Tolita sits at the Northern edge of the emerging Vicuna Copper Belt. Recently, Penoles / Fresnillo ($15-Billion market cap), the Mexican state owned mining companies, have neen exploring adjacent at their Yastai/Nemesis project. They have bought up almost all the land surrounding Tolita and connecting directly into the Lundin Caserones Mine. Penoles has published that they have completed multiple drill campaigns and already have a maiden copper-gold porphyry resource.

Vicunau believes Tolita to have all the hallmarks of large porphyry systems, including massive soil surface signature, mag anomalies, high grade copper and gold on surface, and a significant IP anomaly sitting just beneath the existing drilling. Vicunau intends to rapidly advance Tolita with robust drill campaigns.