- Bank raises year-end copper estimate to $12,000 a ton

- Chinese industry body sees demand destruction due to rally

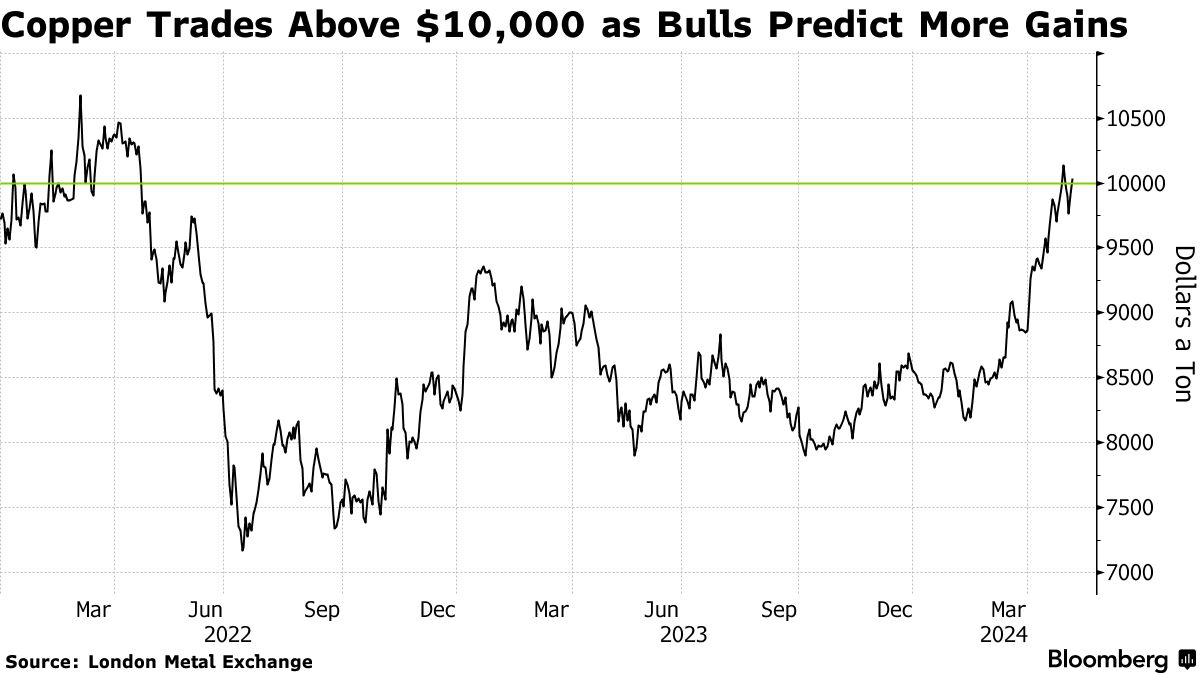

Copper briefly traded through $10,000 a ton as investors raised bets on Federal Reserve rate cuts, and Goldman Sachs Groups Inc. warned of intensifying supply stress.

Metals joined a wider rally in risk assets after soft US jobs data triggered renewed speculation that the Fed will move to lower rates this year. Copper initially rose as much as 2.1% — returning to five digits again after a brief period in late April — before paring gains as trading got underway in Europe.

The prospect of Fed easing is adding to tailwinds for copper as bulls predict further gains with the world’s mines struggling to match growing demand. Goldman raised its year-end price target to $12,000 a ton, from $10,000 previously.

“We continue to forecast a shift into open-ended and mounting metal deficits from 2024 onwards,” the bank’s analysts, including Nicholas Snowdon, wrote in a note. There’s potential for a “stockout episode” — in which inventories run extremely low — by the fourth quarter, they said.

In the US, swaps markets now point to a 53% chance of a Fed rate cut by year-end, up from about 40% at the end of April. And in China, financial markets have returned from an early-May public holiday in a bullish mood on government pledges to boost growth.

Supply Stress

Copper is up 16% in 2024 amid signs of recovery in global factory activity, as well as flashes of supply tightness — especially for raw materials shipped to smelters. Still, skeptics have pointed to soft indicators in China from falling import premiums to buyers holding off purchases.

China’s Struggling Copper Smelters Poised to Get Export Lift

The metal’s gains have been primarily driven by speculation, and may fade as high prices discourage consumption and spur aluminum substitution, Duan Shaopu, a director at China Nonferrous Metals Industry Association, said at a recent press conference, according to a script posted on the group’s WeChat account.

Copper was 0.6% higher at $9,967 a ton a ton on the London Metal Exchange as of 11:02 a.m. local time, as all metals except nickel gained ground.

Source: Bloomberg https://www.bloomberg.com/news/articles/2024-05-07/copper-advances-on-goldman-forecast-and-fed-rate-cut-optimism?embedded-checkout=true

— With assistance from Charlie Zhu, Winnie Zhu, Jake Lloyd-Smith, and Jason Scott