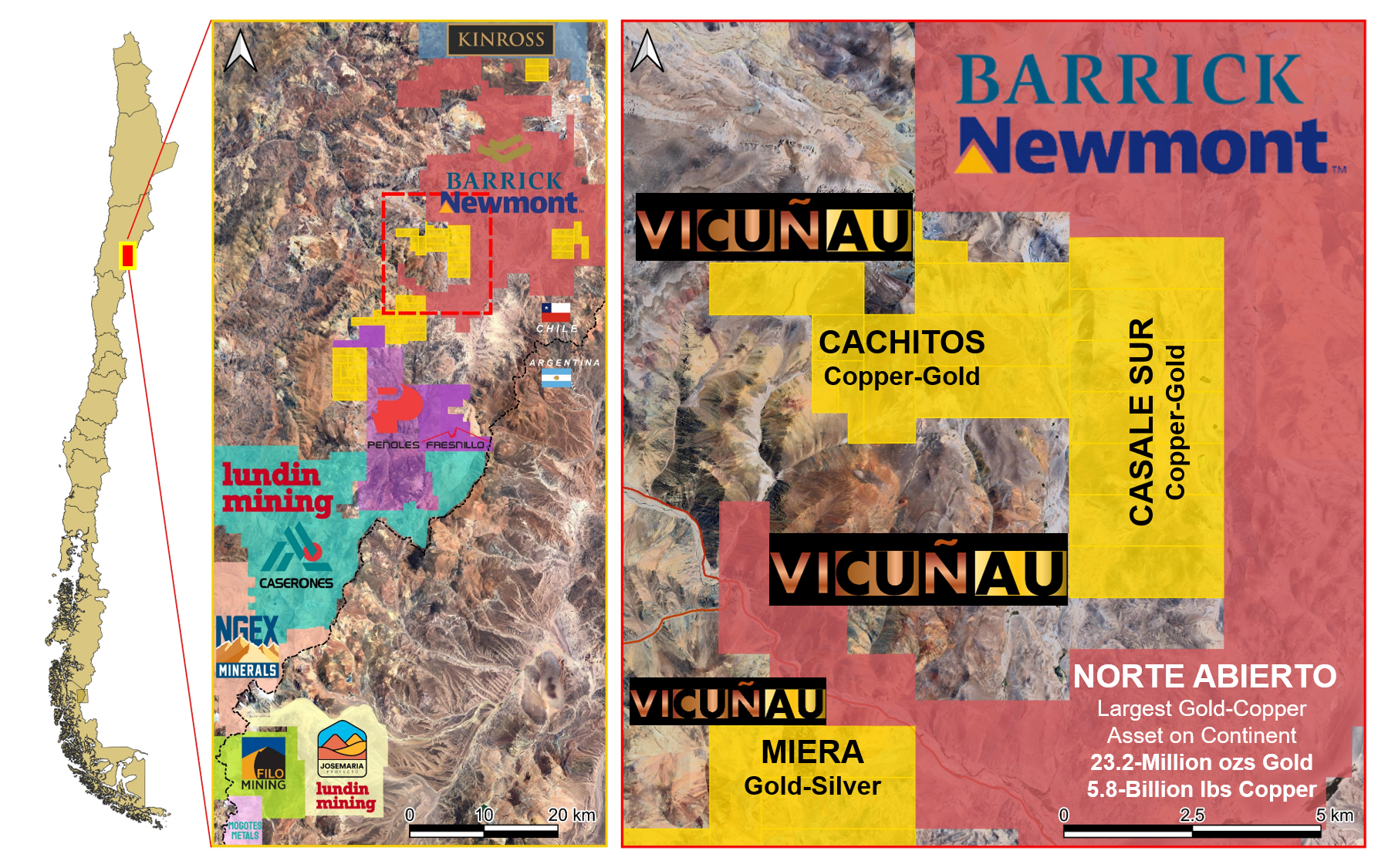

CACHITOS - COPPER-GOLD-SILVER PORPHYRY TARGET AT SW CORNER OF CERRO CASALE

Cachitos was originally personally staked by Dr. Professor Jose Frutos, shortly after he was involved in leading the discovery of Cerro Casale (now apart of the massive Norte Abierto JV controlled by Barrick & Newmont-GoldCorp). Dr. Frutos believes that Cachitos has potential to host some of the Casale porphyry, albeit under host-rock cover.

Although parts of Cachitos were optioned out to another company for ~$10-Million plus a 1.5% NSR in the past, Vicunau owns Cachitos outright, without any liabilities or royalties whatsoever.

Cachitos is an asset that can be advanced quite economically efficiently, requiring a complete grid geochemical survey and subsequently, IP Surveys, before considering drill campaign options.

Cachitos - Adjacent to Mega Cerro Casale (58-Million ozs) Gold-Copper Deposit

Cachitos sits directly at the SW corner of Barrick and Newmont’s Cerro Casale.

Cachitos can be advanced with straighforward geochemical surveys to better understand the property and its potential. While not the focus of Vicunau, a simple grid would take Cachitos to the next level.

We believe an asset like Cachitos provides excellent optionality on both metal prices (copper and gold), and the development of Cerro Casale and Norte Abierto. As Norte Abierto is developed by Barrick and Newmont-GoldCorp, Cachitos’ value-proposition should increase proportionately.

CACHITOS - COPPER GOLD PROPERTY SW CORNER OF BARRICK'S CERRO CASALE

CACHITOS - PRIOR OPTIONED FOR $10-MILLION + 1.5% ROYALTY

Cachitos (together with some adjacent claims) were once optioned for nearly $10-Million plus a 1.5% NSR and published publicly as potentially hosting 2,000,000-4,000,000 ounces of gold.

Vicunau acknowledges that Cachitos is not the Company’s flagship asset simply due to the stage, without existing drilling, but that Cachitos does offer unique leverage to the development of adjacent Cerro Casale owned by Barrick and Newmont-GoldCorp, the world’s 2 largest mining companies.

If Norte Abierto is advanced, as we believe it will be, then the thesis of Dr. Professor Jose Frutos, that Cachitos might host a part of Casale’s porphyry, should become a valuable target.